On Tuesday, February 27, 2024, President Bola Ahmed Tinubu, GCFR, unveiled the Expatriate Employment Levy (EEL), a pivotal measure aimed at organizations employing expatriate personnel within Nigeria. This levy, which carries certain exemptions, is designed to foster skills transfer, bolster knowledge exchange, and maintain a balance between economic progression and social welfare. Moreover, it seeks to fortify collaboration between the public and private sectors while addressing demographic shifts within the workforce.

The EEL, akin to a mandatory travel document such as a passport, necessitates that eligible expatriates present their EEL card during both entry into and exit from Nigeria. This initiative aligns with global practices, as several nations, particularly in the Middle East, have instituted similar levies to either augment revenue streams or regulate expatriate inflows.

Structured to reflect the hierarchy within organizations, the levy is set at $15,000 for expatriates at the directorial level and $10,000 for those occupying other positions.

The handbook, constituting the operational guidelines for the levy, dubbed ‘the Project,’ was concurrently launched by the President. Operating on a Public Private Partnership (PPP) model, the Project entails the Federal Government of Nigeria (FGN), represented by the Federal Ministry of Interior (FMI), as the guarantor, with the Nigeria Immigration Service (NIS) tasked as the implementing agency. However, clarification is warranted regarding dispute resolution mechanisms arising from audits, an aspect yet to be delineated in the handbook.

Employers are mandated to register expatriate employees via an online reporting portal established for this purpose. The effective implementation date of the EEL is slated for March 15, 2024, with a grace period until April 15, 2024, for compliance. Expatriates meeting certain criteria, including those on quota or residing in Nigeria for at least 183 days within a 12-month period, are subject to the levy, whereas diplomatic personnel and government officials enjoy exemption privileges.

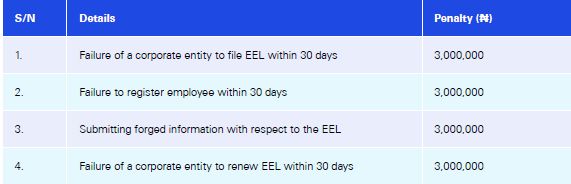

Non-compliance penalties outlined underscore the imperative for accurate reporting, with potential ramifications ranging from imprisonment to substantial fines.

Given the prevailing economic climate, characterized by forex constraints and inflationary pressures, the fixed levy amounts denominated in foreign currency raise concerns, fueling debates surrounding the ‘dollarization’ of the economy. The introduction of a Critical Skills List, akin to prior administrative frameworks, could have provided a nuanced approach to skills acquisition and retention while fostering indigenous talent development.

In navigating these complexities, stakeholders must seek proactive measures to mitigate risks and ensure compliance with evolving regulations. LRAC stands ready to offer specialized guidance tailored to individual circumstances, facilitating informed decision-making amidst regulatory flux.

It is crucial to underscore that the content presented herein offers general insights and should not substitute tailored professional advice. As such, organizations are encouraged to seek specialized counsel to address specific concerns and navigate the evolving regulatory landscape effectively.

Recent Comments